Tips and tricks to keep your Business Financial Health, healthy.

In the wild world of business, we’re no strangers to the rollercoaster of economic highs and lows. It’s a thrilling ride, no doubt, but it can also bring some serious cash flow challenges for our beloved small to medium-sized enterprises. Today, we’re diving headfirst into the art of cash flow planning, and we’ll uncover how our trusty accounting systems can be our ride-or-die partners during these exhilarating yet tumultuous times. Will will be spotlighting Xero, but the principles we’re about to lay down are just as transferrable to MYOB and QuickBooks.

“Growing to Death” – Yeah, It’s a Thing

The term “growing to death” might sound dramatic, but it’s a common phenomenon that often leads to business failure. This phenomenon is not exclusive to startups; even mature businesses can fall victim to it..

Startups often fall victim to this when they’re undercapitalized. They sprint toward success, fuelled by that insatiable drive, only to realize they’ve outpaced their financial resources. It’s like driving full-throttle without checking the gas gauge – not a good idea. Without solid checks and cash management plan it will ultimately end one way.

For more established businesses, the “growing to death” saga usually starts when they stumble upon unexpected opportunities. Think snagging a major sales contract or landing a whale of a client. Sounds great, right? Well, it can turn into a business booby trap if you’re not prepared.

The Missing Pieces: Financial and Cash Flow Management

We’ve got a lot of kick-ass business owners who rock their niches, know their products inside out, and can quote sales figures in their sleep. But there’s a plot twist – when it comes to financial management, that’s where the needle scratches the record. It’s like having all the ingredients for a killer recipe but not knowing how to work the stove.

Sudden business growth comes with a price tag that can hit your profitability or your cash flow. These aren’t one and the same, and many entrepreneurs, who might not have financial expertise, get fixated on profits without looking at the cash flow side of things. You’ve got to master the art of the cash flow dance in your business to rock the growth party.

The Significance of Cash Flow Analysis

So, here’s the deal: you need to understand that sudden changes, especially the ones tied to mega growth opportunities, can have some heavy financial baggage. You don’t want to dive into these changes without knowing what’s in the suitcase, right?

Take Jenna’s story, for instance. She’s been running a small business that’s been on a rocket ride of growth for the past year. Scored five major sales, each ranging from $5000 to $20,000, and they’re all due for delivery within the next three months. It’s like hitting the business jackpot, right? Well, Jonathon’s primary product deal doesn’t come with flexible payment terms. So, the timing between each sale, product procurement, getting it all ready, and waiting for the customer’s payment – it’s a cash flow jigsaw puzzle.

A savvy cash flow analysis reveals Jenna needs an extra $20,000 to $30,000 in cash to make it all happen. Armed with this insight, he can work with his customers to stage the orders, managing his cash flow like a pro. Without that crystal ball, he’d be staring down a 60-day financial cliff, and nobody wants that kind of adrenaline rush.

The Role of Your Accounting System

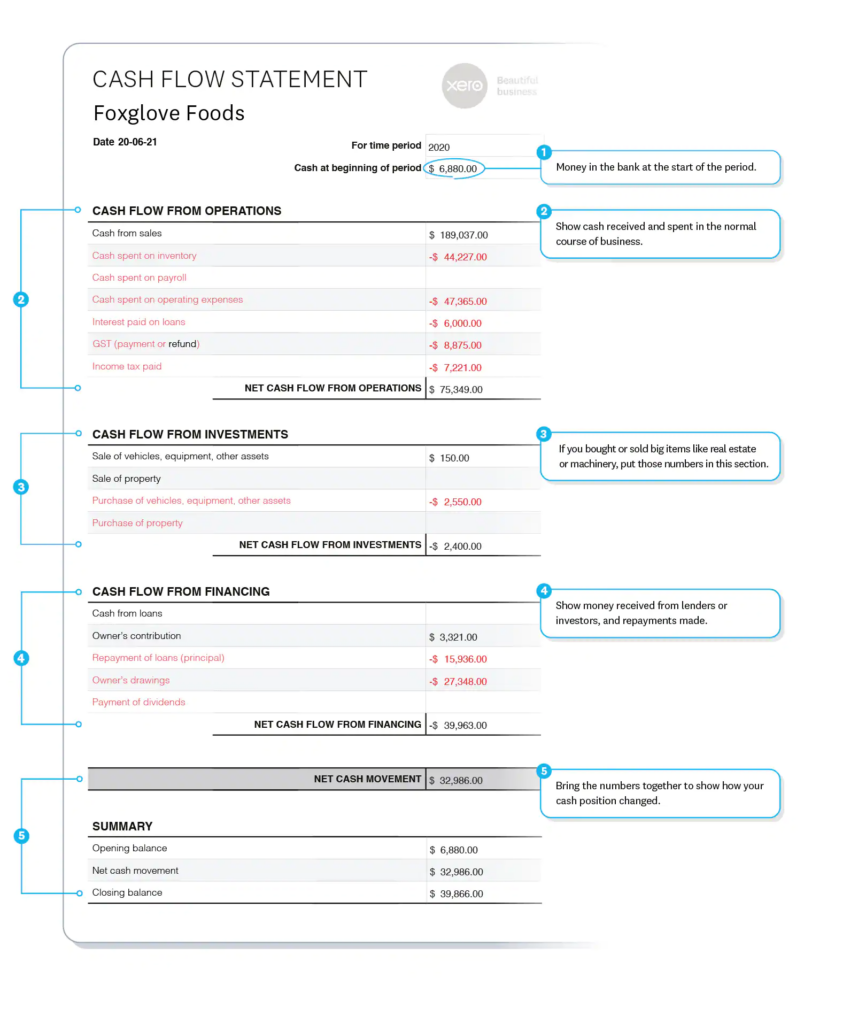

The sweet news is that evaluating cash flow has become more accessible than ever, thanks to powerful and user-friendly accounting systems. Take Xero, for instance. There is a free report called “cashflow statement” which gives you a very high level cash overview:

Alternatively, Xero offer “Analytics Plus” for a pocket-friendly $10 a month, letting you create rock-solid projections.

And don’t worry, we’ve got your MYOB and QuickBooks peeps covered too. They’ve got some stellar resources and guidance in their help centers: MYOB and QuickBooks.

But here’s the deal – automated forecasts are fantastic, but they’re not always dead-on. You’ve got to give them that personal touch by ensuring the inputs and assumptions are correct with your business wisdom.

So, in the grand finale, as we navigate the ever-changing terrain of our business adventures, it’s all about staying vigilant and proactive when it comes to our financial health. By understanding the twists and turns of cash flow, learning from the “growing to death” tales, and taking full advantage of our accounting systems, we can ride the waves of business finance with unwavering confidence. 🌟💪

Now, go out there and rock your cash flow planning, girl boss! If those reports are just not for you, we have you covered with some in house alternative resources:

1. Bloom Masterclass $27

2. Bloom One-on-one planning session $380

🚀💼💁♀️